Choosing a Health Plan (Before You Enroll)

Choosing the right health insurance plan can be confusing, but you're not alone. IllinoisHealthAgent.com has information and resources to help you choose the best coverage for your family's needs and budget. You can also find a licensed assister in your community who can provide free help in person or on the phone.

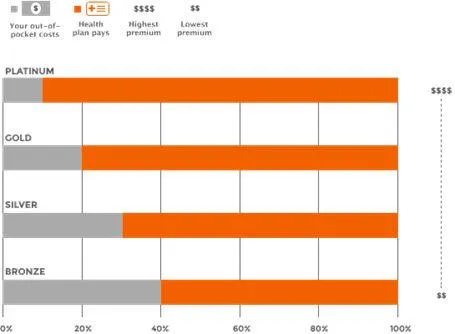

Plan Categories

Plans have different categories based on how you and the plan will share the cost of care. The plan category you choose affects how much your monthly premium will cost each month, the portion of costs your insurance company pays when you use coverage, and your total out-of-pocket costs.

These amounts are averages and they can vary from person to person. Generally, the more you are willing to pay out-of-pocket for health services, like doctor visits or prescription drugs, the less you will pay for your monthly premium. Even though plans have different categories, that doesn't mean that some plans are lower quality. All plans on the exchange cover the 10 Essential Health Benefits.

Things to Consider:

How often do you visit the doctor? If your health care needs are scarce, are you concerned about being able to pay for an unexpected illness or injury if your plan has high out-of-pocket costs?

Through us, most residents will qualify for financial help to lower monthly premium costs or reduce cost-sharing.

Do you have an illness or see the doctor quite often? If so, what costs are you comfortable paying for out-of-pocket?

Only Silver plans are eligible for financial help with cost-sharing, and sometimes this financial help makes the cost-sharing on the Silver plans lower than Gold or Platinum plans.

Plan Types

A provider network is a list of specific doctors, hospitals, pharmacies, and other health care providers that you plan will cover. These providers are called network providers or in-network providers. A provider that your plan does not cover is call an out-of-network provider.

HMO (Health Maintenance Organization)

With an HMO, you may have lower out-of-pocket costs than other plans.

These plans typically do not pay for out-of-network services, or have limited out-of-network coverage, except in emergency situations.

You will need to select a regular doctor, called a primary care physician (PCP), who can refer you to see other doctors in your network, like specialists.

POS (Point of Service)

Generally, POS plans have higher out-of-pocket costs than HMO plans.

Like with an HMO plan, you will need to pick a regular doctor, called a primary care physician (PCP), to help monitor your care. However, you do not have to get permission from your PCP before visiting other doctors in your plan's network, such as specialists.

Some POS plans give you the option of going out-of-network for services, but you will typically have to pay more.

PPO (Participating Provider Option)

PPO plans generally have higher out-of-pocket costs than all other plans.

Most of the time with a PPO plan you do not have to pick a regular doctor or get referrals to see a specialist.

Under a PPO plan, your insurance will pay a portion of your out-of-network costs. This gives you more freedom to choose doctors and hospitals regardless of the network. However, you may pay more for services provided out-of-network.

Things to Consider:

Is your doctor and pharmacy in the plan's network? Is the hospital that you prefer in the plan's network?

Where do you usually see the doctor? If you get health services in many place or travel a lot, does the plan cover out-of-network providers or have a national provider network?

Does the plan require a referral to see a specialist or get other services? Do you like having one doctor who recommends other providers for you?

Plan Costs

There are two main costs you will pay for health coverage:

Monthly Premiums - These are the monthly payments you make to your insurance company even if you don't use medical services.

Out-of-pocket expenses - Your expenses for medical care that are not reimbursed by the insurance. These costs can include deductibles, coinsurance, and copayments for covered services plus any and all costs for service that aren't covered.

Most plans use a combination of these two payment types. Typically, the more you are willing to pay out-of-pocket for your health care, such as doctor visits or prescription drugs, the less you will pay for your monthly premium.

Things to Consider:

Keep in mind the health care needs of your family when deciding which plan to buy. If you expect many doctor visits or regular prescriptions, you may want to consider a plan with lower out-of-pocket costs and a higher monthly premium.

When you complete an application, you can compare plans side-by-side based on price and other important features. You may qualify for financial help to lower your monthly premium or out-of-pocket costs.

IllinoisHealthAgent.com is a free-to-use informational website run by Mohring Insurance Services, LLC. All insurance agents and enrollment platforms linked to this site have their own terms and conditions.

This website is not the Health Insurance Marketplace located at healthcare.gov or the Illinois State Exchange located at getcovered.illinois.gov.

CONTACT US

IllinoisHealthAgent.com & Mohring Insurance Services LLC

Information: 1-866-440-1885

LANGUAGE SUPPORT

Free translation services and assistance by phone is available at:

Healthcare.gov (english).

Cuidadodesalud.gov (espanol).

or by calling (800) 318-2596.

© 2026 Mohring Insurance Services, LLC. All Rights Reserved.